Переезд в Испанию под ключ от 6 недель

Преимущества релокации в Испанию

Мягкий климат, море, свежие продукты и расслабленный ритм жизни — то, за что Испанию выбирают тысячи релокантов.

Испанцы открыты к общению, а природное и архитектурное разнообразие будет радовать вас каждый день.

Испания — одна из самых быстрых и лояльных стран для получения резиденции. Завершить процесс можно всего за 2 месяца.

Спустя 10 лет проживания вы можете подать заявку на получение испанского паспорта.

Программы по получению ВНЖ Испании

Подходит для большинства заявителей. Полностью сопровождаем вас по всем процессам и доводим кейс до получения ВНЖ.

- Знание языка: Не требуется

- Срок действия: 3 года

- Члены семьи: супруг/супруга, дети до 18 лет

- Стоимость от: €100

Подходит даже тем, у кого нет бизнес-плана. Облегченная налоговая нагрузка.

- Знание языка: Не требуется

- Срок действия: 3 года

- Члены семьи: супруг/супруга, дети до 18 лет

- Стоимость от: €3 900

Поможем получить студенческую визу и РВП для всей семьи. Доход не важен, достаточно показать накопления и собрать небольшой пакет документов.

- Знание языка: А1

- Срок действия: 1 год

- Члены семьи: супруг/супруга, дети до 18 лет

- Стоимость от: €500

Подходит тем, кто хочет жить в Испании, но не планирует работать. Достаточно показать источник пассивного дохода.

- Знание языка: Не требуется

- Срок действия: 1 год

- Члены семьи: супруг/супруга, дети до 18 лет

- Стоимость от: €2 000

Для тех, кто хочет работать преимущественно с клиентами из Испании. В зависимости от предыдущего типа ВНЖ, после конвертации резиденцию выдадут на срок от 1 до 4 лет.

- Знание языка: Не требуется

- Срок действия: 1 год/4 года

- Члены семьи: супруг/супруга, дети до 18 лет

- Стоимость от: €1 700

Поможем собрать документы и подать заявку на продление ВНЖ.

- Знание языка: Не требуется

- Срок действия: от 1 года

- Члены семьи: супруг/супруга, дети до 18 лет

- Стоимость от: €1 000

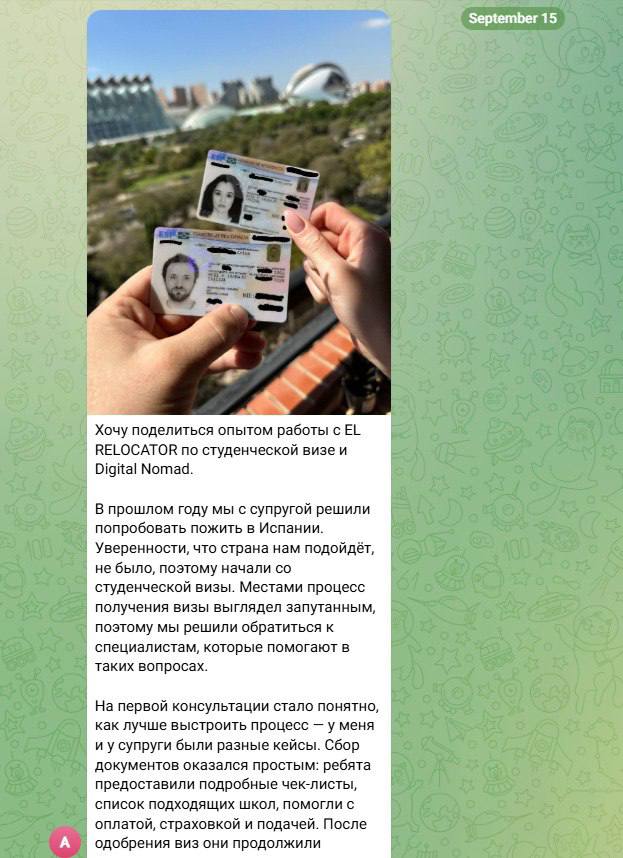

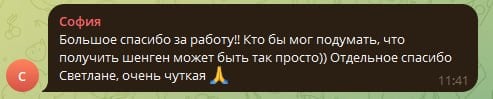

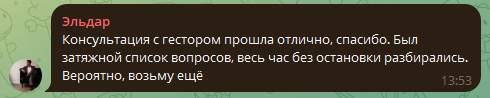

Истории переезда наших клиентов

Сравнение типов ВНЖ

ВНЖ для цифровых кочевников

- Подтверждение дохода (от 2763 евро в месяц);

- Диплом по профессии или опыт работы в сфере не менее 3 лет;

- Компания должна существовать не менее 1 года;

- Вы сотрудничаете с компанией больше 3 месяцев.

- 3 года - первое получение;

- 2 года - продление ВНЖ;

- 5 лет - ПМЖ после 5 лет жизни по ВНЖ.

- Работа с документами (проверка/помощь в истребовании);

- Заполнение бланков для пошлин;

- Подача с помощью нашей ЭЦП;

- Отслеживание рассмотрения вашей заявки в миграционной службе;

- Отправка информации по дозапросу и/или решения;

- Количество предоставляемых услуг зависит от выбранного тарифа.

Зависит от тарифа и количества членов семьи

ВНЖ по стартапу

- Бизнес-план, одобренный министерством экономики Испании;

- Подтверждение финансовой состоятельности для реализации проекта;

- Отсутствие судимостей.

- 3 года - первое получение;

- 2 года - продление ВНЖ;

- 5 лет - ПМЖ после 5 лет жизни по ВНЖ.

- Подготовка бизнес-плана и вашего резюме;

- Индивидуальный чек-лист по сбору документов;

- Безлимитный чат с кейс-менеджером.

- Количество предоставляемых услуг зависит от выбранного тарифа.

Зависит от тарифа и количества членов семьи

ВНЖ без права на работу

- Подтверждение наличия пассивного дохода (от 28800 евро в год);

- Медицинская страховка;

- Наличие жилья в Испании (аренда или собственность).

- 1 год - первое получение;

- 2 года - продление ВНЖ;

- 2 года - повторное продление ВНЖ;

- 5 лет - ПМЖ после 5 лет жизни по ВНЖ.

- Онлайн-консультации на всех этапах сбора документов;

- Заполнение всех анкет и деклараций за заявителя;

- Формирование бланков госпошлин и инструкция по их оплате;

- Стандартный перевод документов на испанский язык (*за исключением справок, требующих присяжного перевода);

- Оплата присяжного перевода;

- Помощь с оформлением страхового полиса (при необходимости);

- Помощь в получении пластиковой карты ВНЖ (заполнение бланков и запись на подачу).

Зависит от количества членов семьи

ВНЖ по ИП (конвертация)

- Диплом по профессии или опыт работы в сфере не менее 3 лет;

- Бизнес-план, одобренный министерством экономики Испании;

- Регистрация ИП в Испании (если вы не студент);

- Подтверждение финансовой состоятельности до выхода бизнеса в плюс.

- 1 год - если до этого был для финансово независимых или ВНЖ кочевника в статусе наемного сотрудника;

- 4 года - если до этого был ВНЖ с правом на работу (например, ВНЖ по стартапу или кочевник в статусе ИП).

- Написание бизнес-плана по требованиям проверяющего органа;

- Консультации по всем документам;

- Подача заявки на ВНЖ;

- Составление анкет за вас;

- Генерация пошлины;

- Разработка бизнес-концепции под вас с нуля;

- Подача документов с помощью нашей ЭЦП;

- Запись на отпечатки.

Зависит от количества членов семьи

РВП для студентов

- Подтверждение наличия накоплений на иностранном счету (от 7200 на год);

- Медицинская страховка;

- Подтверждение зачисления на учебу.

- От 1 года (зависит от длительности программы обучения)

- Онлайн-консультации на всех этапах сбора документов;

- Заполнение всех анкет и деклараций за заявителя;

- Стандартный перевод документов на испанский язык (*за исключением справок, требующих присяжного перевода);

- Помощь с оформлением страхового полиса (при необходимости);

- Помощь с истребованием документов от вуза/языковой школы;

- Помощь в получении пластиковой карты ВНЖ (заполнение бланков и запись на подачу).

Зависит от тарифа и количества членов семьи

Не знаете какой способ переезда Вам подходит?

Условия для получения ВНЖ

Релокация никогда не была настолько простой

Оказываем поддержку на каждом этапе

Подберем оптимальный ВНЖ

Ответим на все вопросы до и после релокации!

Истребуем все документы за вас и получим одобрение!

Снизим налоги

Подберем жилье и поможем интегрироваться

Пошаговый план переезда для каждого способа релокации

- + 25 дней: рассмотрение и возможный дозапрос

- + 10 дней: ответ на возможный дозапрос

- + 20 дней: одобрение

- +14 дней: «ловля» записи и сдача отпечатков пальцев в полиции

- + 30 дней: получение пластиковой карты ВНЖ

- +10 дней: открытие банковского счета

- + 3 дня: открытие ИП в Испании

- + 25 дней: рассмотрение и возможный дозапрос

- + 10 дней: ответ на возможный дозапрос

- + 20 дней: одобрение

- +14 дней: «ловля» записи и сдача отпечатков пальцев в полиции

- + 30 дней: получение пластиковой карты ВНЖ

- +10 дней: открытие банковского счета

- + 3 дня: открытие ИП в Испании

- + 30 дней: рассмотрение и возможный дозапрос

- + 10 дней: ответ на возможный дозапрос

- + 20 дней: одобрение

- + 14 дней: «ловля» записи на отпечатки пальцев

- +1 день: сдача отпечатков пальцев в полиции

- + 30 дней: получение пластиковой карты ВНЖ

- + 90 дней: рассмотрение заявки в консульстве, ответ на возможный дозапрос

- + 14 дней: «ловля» записи на отпечатки пальцев

- +1 день: сдача отпечатков пальцев в полиции

- + 30 дней: получение пластиковой карты ВНЖ

- + 45 дней: рассмотрение и возможный дозапрос;

- + 10 дней: ответ на возможный дозапрос;

- + 20 дней: одобрение;

- + 14 дней: «ловля» записи на отпечатки пальцев.

- +1 день: сдача отпечатков пальцев в полиции;

- + 30 дней: получение пластиковой карты ВНЖ.

Перечень необходимых документов

- Подтверждение существования работодателя (мин. 1 год)

- Документ о подтверждениии образования или стажа (мин. 3 года) с апостилем

- Справка о несудимости с апостилем

- CV (резюме)

- Письмо с разрешением на удаленную работу

- Выписка из банка за последние 3 месяца

- Загранпаспорт с копией всех страниц

- Заявление MI-T

- Чек об оплате пошлины 790-038

- Декларация об отсутствии правонарушений

- Трудовой договор

- Зарплатные листки за 3 месяца

- Свидетельство об отъезде из СФР

- Частная страховка

- Подтверждение существования ИП

- Договор оказания услуг

- Инвойсы за 3 месяца

- Обещание открыть ИП в Испании после одобрения (декларация RETA)

- Загранпаспорт супруга с копией всех страниц

- Свидетельство о браке

- Справка о несудимости с апостилем

- Чек об оплате пошлины 790-038

- Декларация об отсутствии правонарушений

- Заявление MI-F

- Свидетельство о рождении ребенка

- Загранпаспорт ребенка с копией всех страниц

- Чек об оплате пошлины 790-038

- Декларация об отсутствии правонарушений

- Заявление MI-F

- Загранпаспорт с копией всех страниц

- Бизнес-план, одобренный ENISA

- Документ о подтверждениии образования или стажа

- Профиль в LinkedIn

- Справка о несудимости с апостилем

- Выписка из банка с остатком

- Заявление MI-T

- Tasa 790-038

- Чек об оплате пошлины 790-038

- Декларация об отсутствии правонарушений

- Частная медицинская страховка

- Загранпаспорт с копией всех страниц

- Свидетельство о браке

- Справка о несудимости с апостилем

- Tasa 790-038

- Чек об оплате пошлины 790-038

- Декларация об отсутствии правонарушений

- Заявление MI-F

- Свидетельство о рождении ребенка

- Загранпаспорт с копией всех страниц

- Tasa 790-038

- Чек об оплате пошлины 790-038

- Декларация об отсутствии правонарушений

- Заявление MI-F

- Внутренний паспорт

- Загранпаспорт

- Справка о несудимости с апостилем

- Анкеты на визу - 2 шт

- Анкета ЕХ01 - 2 шт

- Частная медицинская страховка

- Медицинская справка 082/у

- 2 фото 3*4

- Оплата пошлины 790-052

- Выписка из банка с накоплениями от 28 000€ (или эквивалент в долларах)

- Мотивационное письмо

- Наличие жилья в Испании (аренда или собственность)

- Свидетельство о браке

- Загранпаспорт

- Внутренний паспорт

- Справка о несудимости с апостилем

- Анкеты на визу - 2 шт

- Анкета ЕХ01 - 2 шт

- Оплата пошлины 790-052

- Подтверждение наличия финансовых средств на члена семьи

- Частная медицинская страховка

- Медицинская справка 082/у

- Свидетельство о рождении

- Загранпаспорт

- Внутренний паспорт

- Справка о несудимости с апостилем

- Анкеты на визу - 2 шт

- Анкета ЕХ01 - 2 шт

- Оплата пошлины 790-052

- Подтверждение наличия финансовых средств на члена семьи

- Частная медицинская страховка

- Медицинская справка 082/у

- Загранпаспорт с копией всех страниц

- Анкета заявителя

- Чек об оплате пошлины 790-038

- Бизнес-план, одобренный одной из ассоцаций ИП в Испании

- Регистрация ИП (Autónomo) — кроме тех, кто переходит со студенческой резиденции

- Подтверждение наличия накоплений на сумму от 16000€

- Документ о подтверждениии образования или стажа

- Загранпаспорт с копией всех страниц

- Свидетельство о браке

- Анкета заявителя

- Чек об оплате пошлины 790-038

- Загранпаспорт с копией всех страниц

- Свидетельство о рождении

- Анкета заявителя

- Чек об оплате пошлины 790-038

- Загранпаспорт

- Справка о несудимости с апостилем

- Выписка из банка с остатком не менее 7200€

- Анкета на визу

- Частная медицинская страховка

- Медицинская справка 082/у

- 2 фото 3,5*4,5

- Оплата пошлины за рассмотрение

- Справка о приеме на учебу: Resguardo de matrícula + чек об оплате

- Подтверждение проживания на срок обучения

- Учебный план с перечислением дисциплин

- Документ о подтверждениии наличия предыдущей степени образования (аттестат со школы, диплом бакалавра и пр.)

- Справка о приеме на учебу: Resguardo de matrícula + чек об оплате

- Подтверждение проживания на срок обучения

Доверьте нам решение всех проблем по релокации

- Подбор

- Аренда

- Покупка

- Оформление прописки

- Помощь в получении ипотеки

- ВНЖ Кочевника

- Стартап ВНЖ

- Студенческое РВП

- ВНЖ для финансово независимых

- Конвертация ПМЖ Европы в ПМЖ Испании

- Виза квалифицированного специалиста

- Конвертация ВНЖ по ИП

Отзывы наших клиентов

О компании

Эль Релокатор — команда экспертов по переезду в Испанию. Мы помогаем с оформлением всех видов ВНЖ — от студенческого до цифрового кочевника — делая процесс понятным и спокойным.

В команде:

— миграционные юристы;

— визовые консультанты с 10+ годами опыта;

— бизнес-аналитики;

— специалисты по подбору школ и вузов.

Более 1000 одобренных ВНЖ, десятки успешных стартапов, тысячи консультаций и даже визы после отказов. Мы не работаем по шаблонам — только персональный подход с первого дня.