Spain Digital Nomad Visa Guide 2024 - El Relocator

El Relocator project has prepared a knowledge base, after studying which you can obtain a Nomad residence permit on your own!

This is a residence permit in Spain that is issued for 3 years, with the possibility of one renewal for 2 years and then obtaining permanent residence and even Spanish citizenship.* In Spanish, it is called “Teletrabajador de carácter Internacional”.

The advantages of this residence permit:

- It is possible to travel within the EU and the Schengen area without restrictions

- There are no restrictions on opening bank cards/accounts in Spain

- You can apply for a US/UK/Japan visa without leaving the EU

- It is possible to bring family members (spouse, minor children…)

- There is a limited right to work in Spain (for family members – no restrictions on the number of hours per week)

- Children can study at prestigious international schools and universities

- To obtain and renew it, you do not need to take Spanish language exams

A number of Spanish consulates accept documents for a Digital Nomad visa for 1 year, followed by a residence permit for 3 years. However, so far the most common application option is directly for a residence permit directly from Spain. The next guide will focus specifically on a residence permit.

Below are the main points to pay attention to. The «documents» section contains comments on individual documents, which should also be studied before submitting.

- Revenue source. Your employer can be in any country except Spain. (Russia or Belarus are suitable.) You can work as an individual entrepreneur or self-employed, or simply as an employee under an employment contract, or even receive royalties as a freelancer.

- Revenue. It is necessary to receive 200% of the Spanish minimum salary, i.e. 2,646 euros per month for the main applicant. (It can be uneven, as long as 31,752 euros per year.) If you bring your family with you, you will need to show +75% for the first family member (992 euros) and +25% for each additional member (330 euros).

- Labor organization. You must specify the main organization from which you receive money (even if there are several such organizations) and show that: – This organization has existed for more than 1 year; – You have been working with it for more than 3 months – an employment contract/service agreement; – A letter stating your position, salary converted into Euros and confirming that the organization does not mind that you work remotely from Spain.

- Diploma or proof of at least 3 years of work experience. If your profession coincides with your position, then a diploma of education will do. If this is not the case, you need proof that you have at least 3 years of professional experience.

- Summary – CV in Spanish (Can be translated by online translator)

- Visa (depending on nationality). To apply for a nomad residence permit, you must legally reside in Spain (you can use a tourist visa from another country or a Spanish student Estancia).

- Digital nomad visa. Type D visa for 1 year, which can be obtained outside Spain (at the Consulate of the place of official residence).

- A residence permit for a digital nomad. This concept is often confused with a visa (including earlier in this text). However, there are 3 key differences: a residence permit can only be applied from Spain, this can be done on the Ministry’s website (“UGE”), and it can be issued for 3 years at once. Otherwise, there is no difference.

- Sworn translation (Traducción jurada). This is when a licensed translator not only translates, but also puts his official stamp confirming the correctness of the translation. The number of such interpreters is limited. They usually translate government documents. For example, no criminal records or diplomas.

- Apostille – an international standardized form for filling out information on the legality of the document for presentation in countries that recognize this form of legalization. The “Apostille” stamp is placed on the originals and copies of documents. It can be issued by various authorities (for example, the Ministry of Internal Affairs or a notary).

- NIE – Número de Identidad de Extranjero – A foreigner’s ID number in Spain, which can be obtained if there is any reason for this (student TRP, buying a car, buying a property, etc.). NIE is usually assigned automatically after approval of the residence permit. This is a very important thing that is required almost everywhere in Spain.

- “Certificado Digital” digital signature. A digital signature that is valid in Spain. It is needed to apply for residency. It can be issued at the Spanish consulate at your place of residence or directly in Spain through a special website. However, it is impossible to obtain a digital signature without a NIE.

- Sita (Cita previa). This is the common name for making an appointment with various administrative authorities in Spain for various reasons. You need to buy Sita online, and for some things it’s very difficult to do this – slots fly out instantly. (For example, to submit fingerprints to obtain a plastic residence permit card.) Sita is usually needed to register, submit fingerprints, obtain a residence permit card, and obtain a “Return Permit” certificate.

- TIE – Tarjeta de Identidad de Extranjero. A plastic identification card for a resident foreigner proving his identity in Spain. It usually has a NIE number on it. As a result of all procedures, you need to get this particular card.

There are many different taxes in Spain, but generally, a Digital Nomad will deal with the following: Personal income tax, social insurance, VAT.

PERSONAL INCOME TAX: Applicable to all nomads

Social security: Applicable to nomads with Autónomo status (sole proprietors, Self-employed people who are not covered by their country’s social security certificate.)

VAT: In some cases, it is applicable to nomads who do business in the EU.

Our team also provides individual advice and assistance in registering and selecting tax regimes.

Spain also has online accounting services for individual entrepreneurs. Among them are: xolo.io, taxdown.es, taxscouts.es, finutive.com

Let’s look at each tax in more detail:

PERSONAL INCOME TAX

Personal income tax.

It is paid on a quarterly basis from the declared annual income.

A digital nomad needs to choose one of the personal income tax modes:

Beckham mode:

(Ley del IRPF en su Artículo 93)

The tax is levied on all income earned in Spain, as well as income from work and professional activity earned abroad. Deductions and IDNs do not apply in this mode.

- Up to 600,000 EUR per year: 24%

- From 600,000 EUR per year: 47%

Example:

Dmitry has the following annual income:

- Salary in an IT company in the Russian Federation: 60,000 EUR before taxes

- Business income from an individual entrepreneur: 40,000 EUR before taxes

- Renting an apartment in the Russian Federation: 12,000 EUR

- Dividends from a share in an LLC in the Russian Federation: 5,000 EUR

Calculating how much Dmitry will pay in Beckham mode:

(60,000 + 40,000) * 24% = 24,000 EUR

Dmitry’s other income will not be taken into account.

Dmitry will have to pay 24,000 EUR in total for 1 calendar year.

General mode:

A progressive scale applies to income for 1 calendar year, from any source around the world.

All income and property around the world are declared: real estate (according to cadastral value), bank accounts, savings…

Common mode has 2 subtypes:

Standard (Base General) – you have to pay on basic income (salary, renting an apartment, income from contracts, etc.)

Amounts per year:

- Up to 12450 euros – 19%

- 12450.01 – 20200 – 24%

- 20200.01 – 35200 – 30%

- 35200.01 – 60,000 – 37%

- 60,000.01 – 300000 – 45%

- 300,000,01 – infinity – 47%

“Savings” (Base de Ahorro) – This includes profits from deposits, shares, bank accounts, crypto, dividends, proceeds from the sale of an apartment…

Amounts per year:

- Up to 6000 – 19%

- 6000 – 49999 – 21%

- 50,000 – 199999 – 23%

- 200000 – infinity – 27%

To calculate the total tax amount, you need to determine the income within each of these ranges and apply the corresponding rate. Then, all the values obtained should be added up, and the result will be the total amount of income tax.

It should also be noted that taxes may vary in different autonomous regions of Spain, as they have the right to set their own tax rates and benefits.

Currently, the autonomous regions of Madrid and Castilla y León are the most effective in terms of personal income tax, as they have the lowest tax scale and Catalonia is the most expensive, with the highest rates in Spain.

Under the general regime, it is also possible to use various tax deductions and Double Taxation Agreements.

What tax deductions can be made?

(Vary depending on the autonomous region)

Base General has the following:

- Donation deductions (with restrictions…)

- Business investment deductions (30% of investments with a limit of 60,000 per year).

- Deductions for improving the energy efficiency of housing.

- Maternity capital deductions in the amount of 1,200 euros per year (during the first three years of a child’s life).

- Deductions for large families (from 3 and increases with the number of children).

- Rental deductions only if the lease agreement was concluded before 2015. However, there are deductions for rental housing in the regional tax scale with various restrictions on amount and age.

- Deductions to encourage investment in economic activities (applies to Autónomos)

- Social Security Deductions (for Autónomos)

Example:

(The calculation is for general cases and does not take into account possible regional and special deductions).

Anton works for a Russian company and earns a pre-tax salary of €5,000 per month.

At the same time, he has cryptocurrencies, a couple of deposits, and a stake in a small LLC. Anton still has an apartment in Moscow, which he has been renting out since 2014 for €550 a month, and a car he sold in December 2022.

In March 2022, Anton received a residence permit in Spain and is now thinking about how to pay taxes for 2022.

Annual salary: 5000×12 = 60000. Rent: 550×12 = 6600

Deductions: 13% of personal income tax with salary that Anton will pay in Russia.

Total: 66600 – 7800 = 58000

Anton will pay 2,365 of the first 12,450 euros. Of the next 7,750, he will pay 1,860. Out of the next 15,000, he’ll pay 4,500. Of the remaining 22,800, he will pay 8,436.

Thus, Anton will pay 17,161 euros out of his income of 58,000 euros. This is an average = 29%.

But don’t forget that Anton also has savings, deposits, etc. Of all this, he made a total annual profit of 37,000 euros.

He managed to sell his car for 15,000 euros, but it doesn’t need to be declared as he did not make a profit.

Of these 37,000 euros, tax will have to be paid as follows:

From the first 6,000 euros – 1,140 euros. Of the following 31.000 euros, 6,510 euros.

Thus, Anton will pay 7,650 euros out of his passive income of 37,000 euros. That is, on average = 20.6%.

Since the Russian Federation and Spain are still using Double Taxation Agreement (for the 2022 reporting year for sure, the information will be available in 2023 closer to the end of the year), it is possible to deduct part of the taxes paid in the Russian Federation from the tax in Spain.

****The income from the individual entrepreneurship simplified tax system cannot be offset, since the simplified tax system does not apply to the Double Taxation Agreement, as well as to self-employment.

Social security

Insurance contributions to the Spanish Social Fund (Seguridad Social) for sole proprietors, Self-employed or Freelancers.

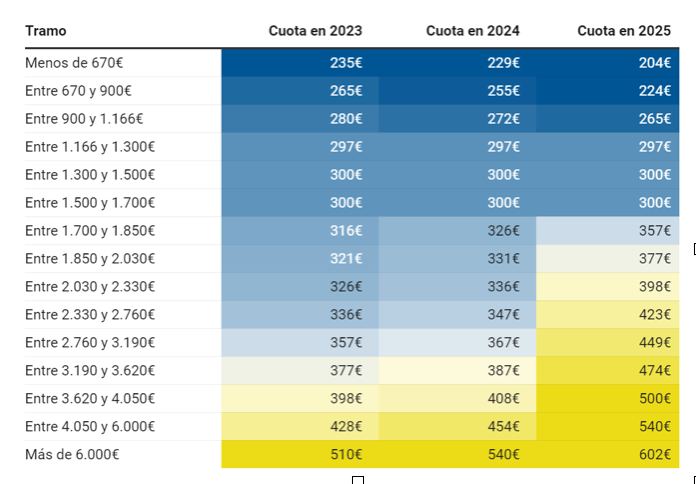

If you are obtaining a Nomad Visa as Autónomo (Individual Entrepreneur, Self-Employed, Freelancer) and are not covered by your country’s social security certificate, then you need stand up register with Spanish Social Security and pay monthly contributions there depending on your monthly income:

For the first year, there is a reduced rate of 80 euros/month

There is a convenient calculator for calculating contributions.

The amount of contributions paid can then be deducted from the general personal income tax base if you are on a general basis.

VAT (Value Added Tax) in Spain is called Impuesto sobre el Valor Añadido (IVA). This is an indirect tax that is levied on the sale of goods and services at every stage of the production and distribution chain.

**Only applies if you run your own business and/or sell your services.

In Spain, there is a standard VAT of 21% and a reduced 10% or 4%. **Reduced is used for food, books, public transport…

IN GENERAL:

If you are registered as Autónomo in Spain and do business with customers from the EU or Spain, you will be required to issue VAT invoices to your customers at a rate of 21%.

If your customers are outside the EU, the services provided will be considered exports and you will not have to charge them VAT (as they will be exempt).

Since all situations are individual and there may be exceptions everywhere, we strongly recommend that you consult a tax lawyer about your case!

- MI-T application in Spanish confirming your intention to obtain a residence permit and work remotely. You can fill it here

- Passport with a visa and a copy (scan) of all pages. If you are entering Spain from another EU country (there is no Spanish entry stamp), you must take a certificate of entry to Spain. They are handed over to the police at the border crossing point. At the airport, for example. The document is called “Declaration de Entrada”.

- Proof of employment for at least 3 months before applying for a residence permit. For example, a work contract that should specify your salary. Minimum: – 2646 euros/month for the main applicant, +992 euros/month for the first family member, +330 euros/month for each subsequent one. The contract must be in Spanish OR translated by a sworn translator OR consular translation (legalization).

- Bank statement confirming the transfer of payment under the contract for the last 3 months. You can show it in English, or a free translation into Spanish.

- Proof of at least 3 years of work experience in your specialty (employment book/individual entrepreneurship registration certificate) OR a diploma (preferably with an Apostille if issued outside the EU) if the profession is related to your job. The document must be translated by a sworn translator OR consular translation (legalization)

- A letter from the company, allowing remote work from Spain and confirming your status as a digital nomad. The letter must now include the salary in Euros. A free translation into Spanish is suitable.

- Proof of the existence and activities of the company where you work (for example, a statement from the Unified State Register of Legal Entities) for at least 1 year. The document must not only be Apostilled or consular legalized, but must also be translated by a sworn translator (Traducción jurada).

- A police clearance certificate with an apostille from all countries where you have been for more than 6 months in 1 calendar year. The certificate must be from the last 2 years. A sworn translation is required.

- Declaration about the absence of serious offences over the past 5 years. It is completed in Spanish.

- Private medical insurance valid in Spain (for sole proprietors there is a variant do without it). Travel insurance is not suitable.

- Payment state fees for considering your application for a residence permit (check+form).

- Social Security Certificate from the Social Fund of Russia (departure certificate). (If your employer is from the EU or if there is a social security agreement between the employer’s country and Spain, you can request a relevant certificate.) The document must be translated by a sworn translator OR consular translation (legalization)Attention: An individual entrepreneur/Self-employed/Civil contract can do without this certificate and register with Spanish social security on their own. To do this, you will need to write a free-form application in Spanish and attach it to the rest of the documents.

- Resume in Spanish (CV).

For family members additional documents such as birth and marriage certificates, as well as police certificates for adult applicants, will be required.

If birth and marriage certificates are issued in the Russian Federation, they may be without an apostille, but a sworn translation is required.

Family members must also fill out an application for a residence permit called MI-F.

Please note that the migration service has the right to request any additional documents when considering your application for a residence permit for digital nomads.

For example, individual entrepreneurs are periodically asked for a certificate confirming this status, as well as invoices for the last 3 months before submission.

Collect documents well in advance and check that they are up to date to avoid possible delays and problems with applying. Be prepared for possible requests for additional information from the migration authorities and be flexible in the process of collecting documents, as requirements may vary from case to case.

Attention! The Spanish administrative authorities accept certificates no older than 3 months from the date of issue. The exception is no criminal record certificates: they are valid for 6 months (unless the certificate itself specifies a deadline).

Obtaining and working with certain documents often raises questions. Here we have collected and updated explanations of all things that cause controversy.

If you’re hired:

Ask your company to compose this letter on letterhead, stamped and signed.

Sample text:

This certificate confirms that the FULL NAME working for the company NAME in the position JOB TITLE from DATE has the right to perform his duties remotely using digital communication tools and without being at the company’s place of registration in the COUNTRY.

The employee’s duties include: LIST.

The monthly salary of a FULL NAME before taxes is??? , or Euro/month at the exchange rate of the Central Bank as of the day the letter was written. The contract with the employee is concluded until:???

The company NAME allows a FULL NAME specialist to work under this agreement while in the Kingdom of Spain.

If you are an individual entrepreneur:

Ask your counterparty, whose contract meets the visa requirements, to compose this letter on letterhead, stamped and signed.

Sample text:

This certificate confirms that an Individual Entrepreneur, FUL NAME, with whom an agreement was concluded on DATE, has the right to perform the services specified under this agreement (SPECIFY SERVICES) remotely, using digital communication tools and without being at the place of registration of the company in the COUNTRY.

The monetary reward under this contract, before taxes, is??? , or Euro/month at the exchange rate of the Central Bank as of the day the letter was written.

The contract with the counterparty was concluded before:???

The company NAME allows a FULL NAME specialist to work under this agreement while in the Kingdom of Spain.

Fill in this document in Latin letters and sign it. (You state in Spanish that you have not broken the law in the past 5 years)

Declaration of no criminal record

Field interpretation:

Nombre y apellidos: Full name

Nacionalidad: Citizenship

Fecha de nacimiento: Date of birth

DNI/NIE/Pasaporte: Passport number

Domicilio: Address in Spain (street, house, apartment)

C.P.: Postcode

Localidad: City/Village

Provincia: Province (e.g. Girona)

/Text block/

En (name of the city where you are currently) a (number) de (month) de (year)

Firma:/applicant’s signature/

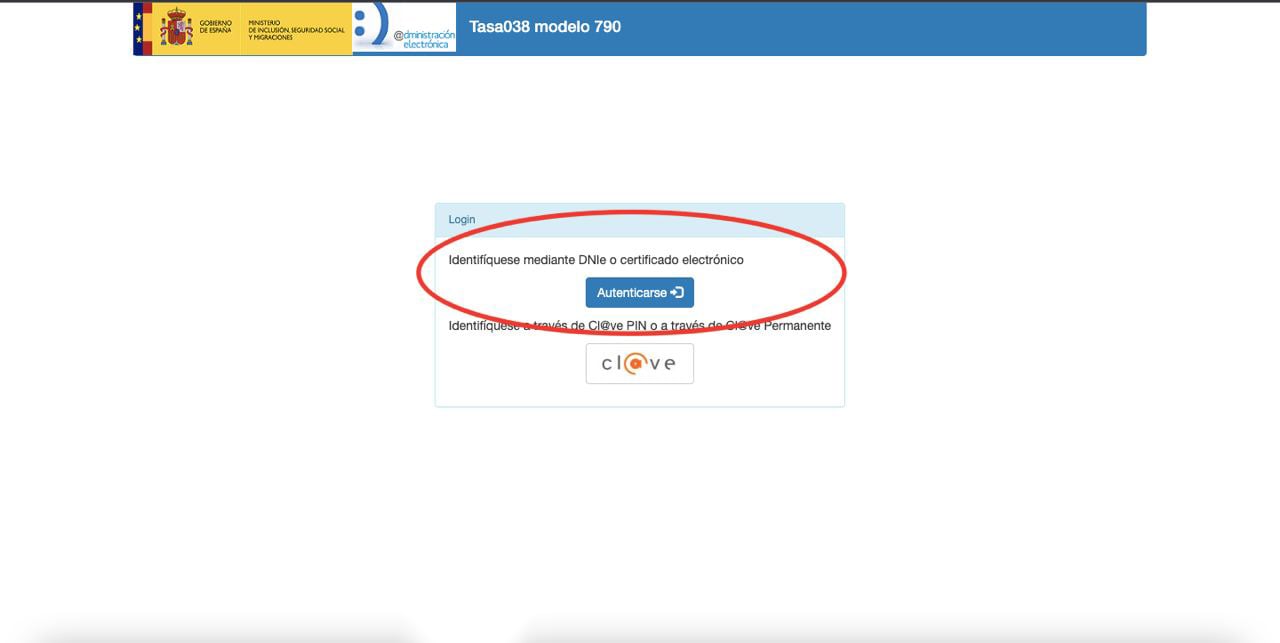

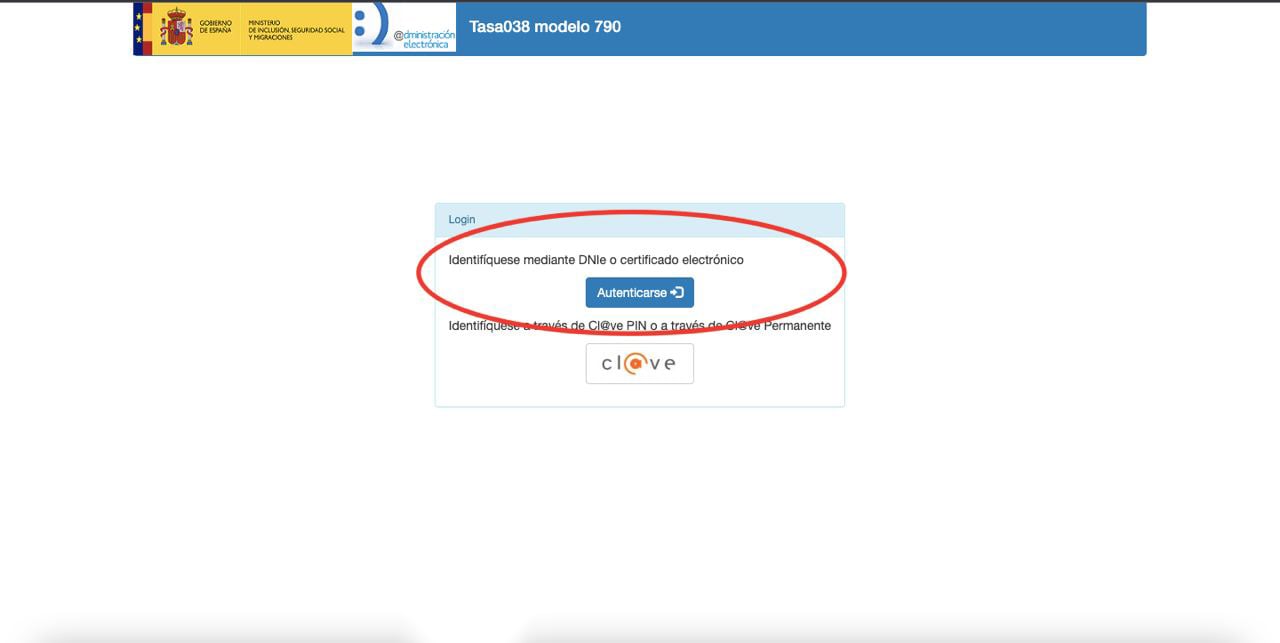

In order to pay the digital nomad’s residence permit fee, you need to go to link and log in via DIGITAL SIGNATURE:

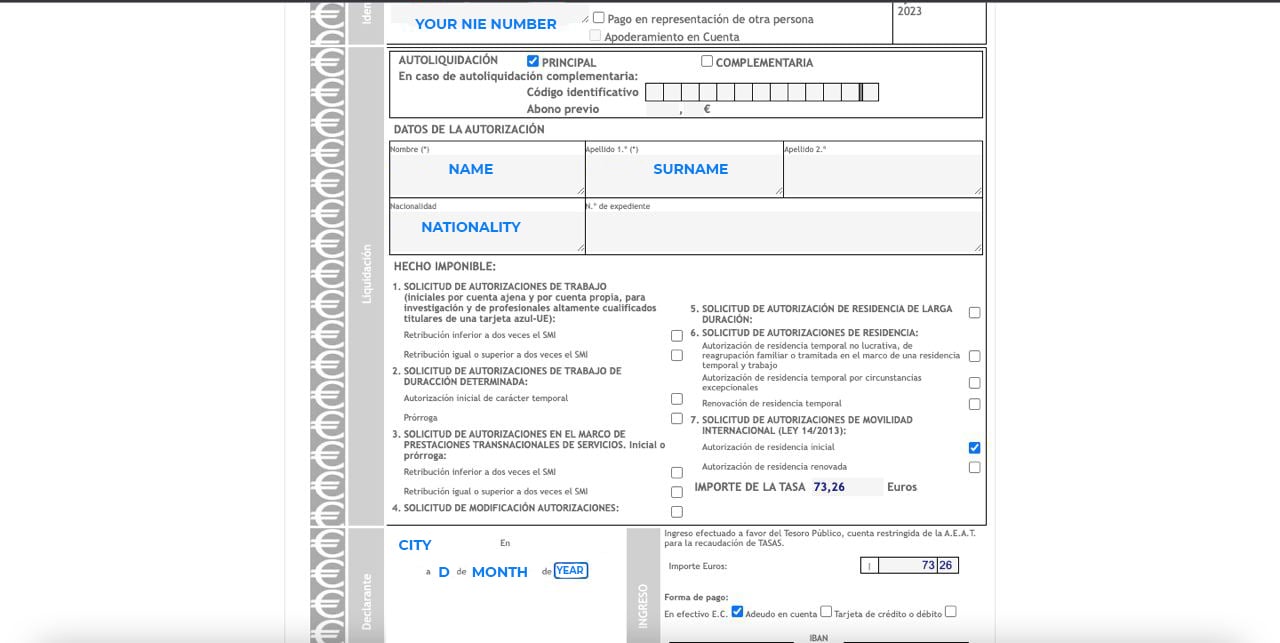

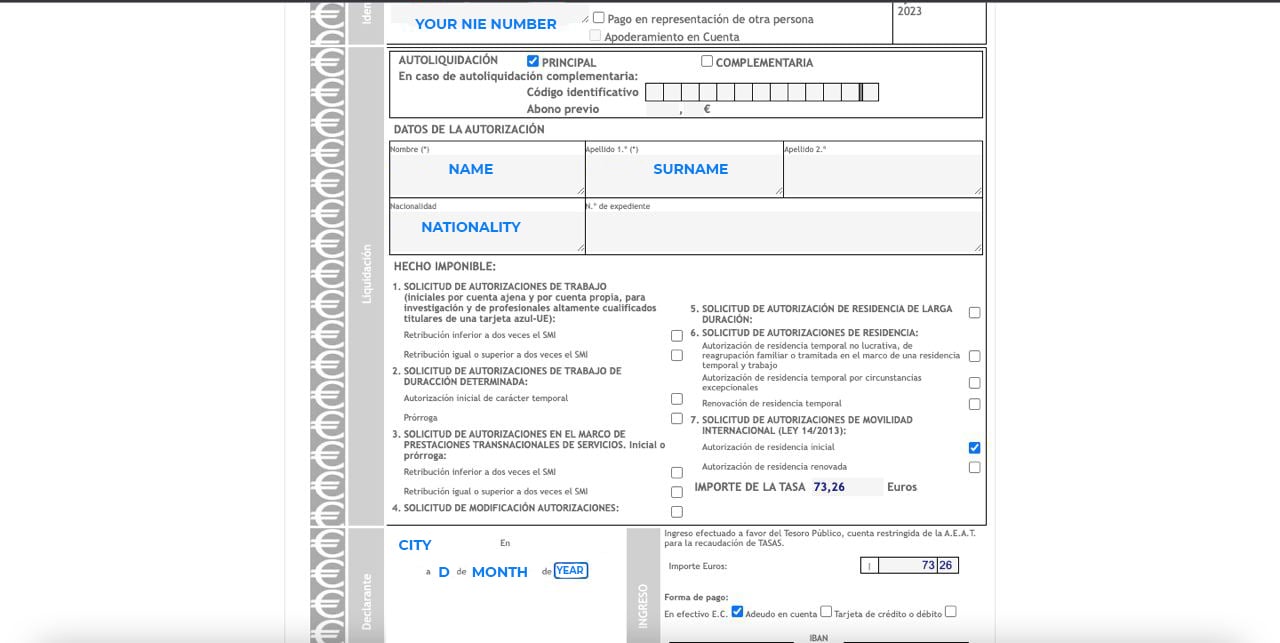

If you pay for yourself, fill in the data like this:

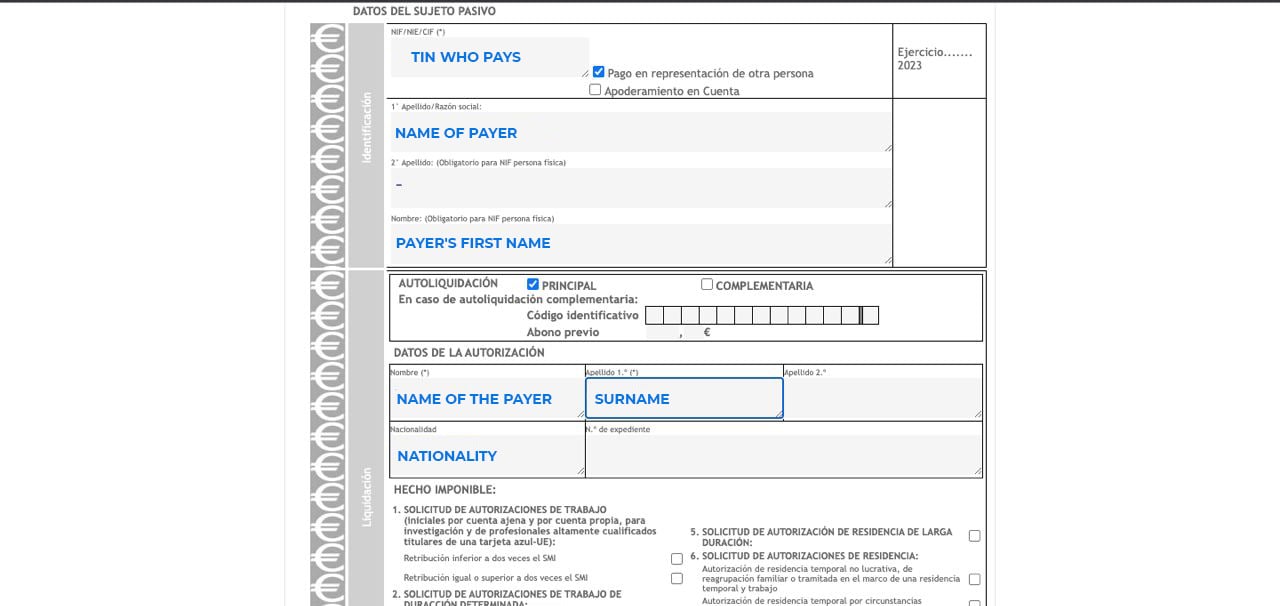

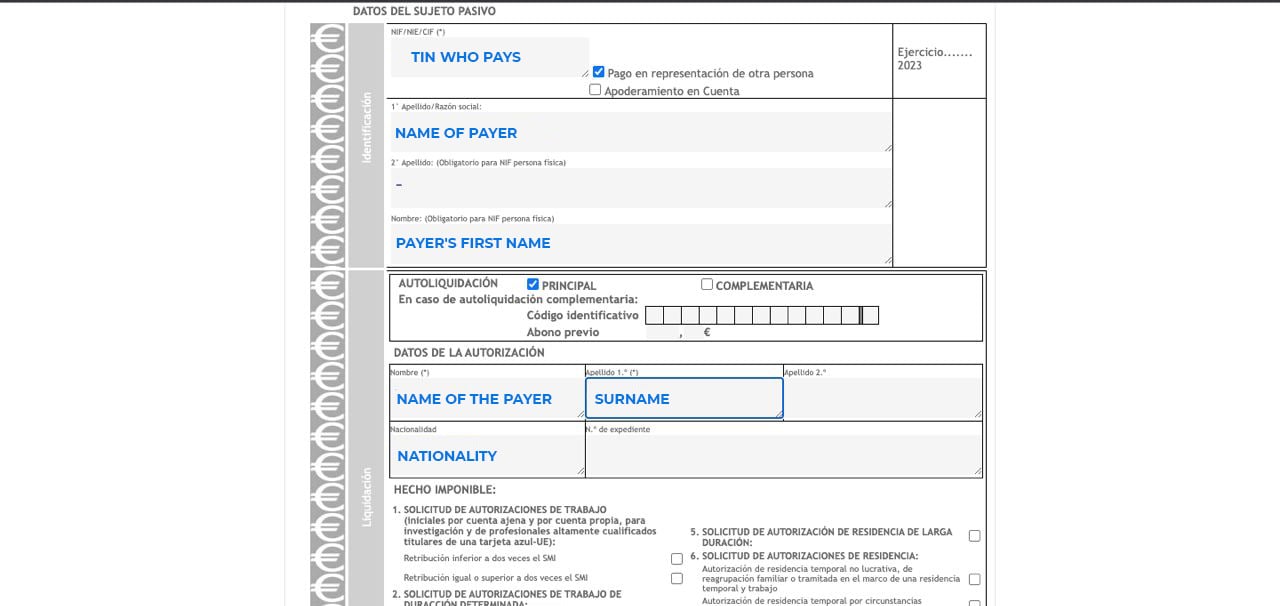

If you pay for another person, fill it out like this:

After filling in, click on the “Imprimir tasa” button at the end of the page and download the finished payment document. You can pay the fee in cash at a bank or ATM. The fee is 73.26 euros.

A separate fee is required for each family member!

Do not forget to take a proof of payment; it must be attached to the application for a residence permit.

If you are employed by a company from the Russian Federation, you need to take a document called the “Departure Certificate” from the Social Fund of Russia. It usually has this format, but there may be minor variations, depending on your territorial Social Fund of Russia.

If you are an individual entrepreneur or self-employed – you don’t have to take this document, by making a commitment register with Spanish Social Security and pay insurance premiums to it. (The first year — 80 euros/month, from the second year — about 270 euros/month. The exceptions are Madrid, Galicia, Andalusia, the Canaries, the Balearic Islands, Castilla la Mancha, where you don’t have to pay for social security for the first year.)

An employee should contact the Social Fund of Russia authority at the place of registration of the employer. Without this certificate, a nomad cannot be hired.

The individual entrepreneur applies to the Social Fund of Russia authority to which it is attached.

You need to bring your passport, a certificate of employment, and a copy of the employment contract.For individual entrepreneurs – copies of documents for registering an individual entrepreneur and registering in the Pension Fund of the Russian Federation

Note: Some Social Fund of Russia offices now issue this certificate only if you give them an order to send you on a business trip. Entrepreneurs can write such an order for themselves. The certificate itself should not include the names of Spanish companies. Such a certificate will be refused.

Departure certificate

Social security sample for sole proprietors

UPD departure certificate

(Some branches use the old form, and some use the new form).

Download this document, fill in the details and sign it.

Spanish Social Security Application

The visa process consists of the following steps. Some of them can run in parallel:

- Assessing your chances of getting it. Spaniards are loyal to digital nomads, but, of course, before you start collecting documents, you should read this material and assess the chances of success, as this process takes time, takes time, takes effort and costs money.You can contact our expert @EL_POMOGATOR for advice and he will assess your chances of success.

- Collection of documents. Since all applications for a residence permit take place online, all documents are required only in electronic form. However, some documents must be apostilled. For example, a police clearance certificate, a certificate of company existence, a notarized consent to the child’s move (if only 1 parent is moving), a birth or marriage certificate (if issued outside the Russian Federation).

Spaniards have the right to request an apostille on any government document. - Translation of documents into Spanish.

Some documents only require a sworn translation (for example, a police certificate or a constituent document of the client/employer). Some can also be translated by yourself (for example, a letter from a client/employer).

List of sworn translators in Spain: see. - Applying for a digital nomad residence permit. This must be done online through a special UGE portal.

It is important to be in Spain at this time. The submission portal itself can only be accessed with a Spanish electronic signature.

The deadline for consideration of the application by administrative authorities is up to 20 working days. As of August 2023, there were minor delays in the review, but there is no need to be afraid of such a situation either; this does not mean refusal. - Receiving a response from government agencies to your application (one of them):

Approval;

Request for additional documents (for example, bank statements);

Refusal (you can appeal); - (optional) Collection of additional documents (everything here is individual, at the discretion of the migration officer).

- Registration (Empadronamiento). You don’t need a residence permit to be fingerprinted in Barcelona or Madrid… but in general, you do need a residence permit to live in Spain. However, fingerprints can only be taken within your province. That is, if you are in Lloret de Mar (Girona), you cannot come to Barcelona and take your fingerprints there. (The only exception is the section in Reus, which receives everyone after 3 pm.)

- Submission of fingerprints. To do this, you must already be in Spain, sign up for an appointment at a special police station and come on your own. You must have a passport-like photo, a printed paper approving a residence permit, an application for a card, a registration document (except for Madrid and Barcelona), a duty receipt (16.08 euros), a passport and a printed sieve.

- Obtaining a resident card. This is done offline. Some police stations need sita for this, some don’t. Usually, the card production time is 40 calendar days.

Obtaining a Spanish digital signature:

From Spanish territory:

To apply for a residence permit, a Spanish electronic digital signature (EDS) is required. To get a digital signature, you first need to get a Spanish Taxpayer identification number (NIE) number. To do this, you must sign up for Policia Nacional. However, recently NIE numbers have been issued to foreigners only if there are good reasons, for example, to buy a home. In this case, you may need a formal sales contract template for the property you are going to buy.

Obtaining an electronic signature on your own

From your own country (for example, the Spanish Consulate in Moscow):

This process may take 6 weeks due to the reduction of diplomatic staff.

First, you need to request a NIE number by sending an appropriate form for assessment without a signature via email. The basis for extradition is Solicitude del visado de teletrabajador de carácter internacional, Ley 28/2022 (specify in the application form). If everything is ok, you will be made an appointment at the consulate, where you will need to pay the duty (in rubles, in cash).

After that, you will need to wait about 3 weeks for you to be assigned a NIE number.After that, you need to request a digital signature (see the link above) and sign up for proof of identity. You need to sign up by phone. After your visit to the consulate, your signature will be activated in 1-2 days.

State duty payment:

You can only pay the fee from a card or from an account in one of the Spanish banks (BBVA, La Caixa, etc.). Fintech companies like Wise or Revolut are not suited for this purpose.

Cash payments are possible, but not at all banks and ATMs. Please note that banks in Spain are usually open until 2:00 p.m. on weekdays.

Filling out an application in Spanish:

All applications must be completed in Spanish. Errors due to lack of language proficiency may result in your application being refused. It is recommended that you contact a professional translator or lawyer to verify that the application has been completed.

Declaration of entry:

If you are coming to Spain from another Schengen country, you must take a declaration of entry – “Declaration of Entrada”. To do this, you need to find a police station where such documents are issued. For example, at Barcelona airport, terminal T1 (don’t forget your boarding pass).

Fingerprint appointment:

It can be difficult to obtain a fingerprint appointment due to limited space. In addition, the police station will only speak Spanish with you. To simplify the process and avoid problems, it is recommended to fill out documents in advance or use the services of an interpreter.

In order to successfully complete all the stages of applying for a residence permit in Spain, it is important to carefully prepare and familiarize yourself with the process in advance.

If you are a sole trader in one of the countries that have a social security mutual recognition agreement with Spain, * you can choose between two options.

Variant 1 (hiring, individual entrepreneur): Provide Spain with a certificate that you are covered by social security in your country (departure certificate) + buy private health insurance in Spain. (Travel insurance or Schengen visas are not suitable. You need insurance from one of the Spanish insurance companies. For example Adeslas, Sanitas, DKV…)

Pros: Private insurance can be serviced in large private hospitals and medical centers.

This is cheaper than paying social security, as the average cost of private insurance with full coverage is 60 euros/month, and the social security contribution is 300 euros/month, starting from the second year (the first year is 80 euro/month)

Variant 2 (for individual entrepreneurs, self-employed, freelancers): Register with the Spanish social security system (after obtaining a nomad residence permit). In this case, you do not need to purchase private health insurance. Also, this option does not require a departure certificate.

Pros: In addition to access to public hospitals, you have accumulated retirement experience and the opportunity to receive various state benefits (for childcare, for example).

For a family of three or more people, this option will be comparable or even cheaper than private insurance, since the total cost of private insurance for a family with young children will be approximately 250 euros/month

If the country in which you are registered as an individual entrepreneur does not have an agreement with Spain on the mutual recognition of social security, then you will need to register with the Spanish social security system (after obtaining a nomad residence permit). In this case, you do not need to purchase private health insurance.

What should I do if I am employed in a country where there is no social security agreement?

Revise your sole proprietor/freelance agreement, wait 3 months, promise to register with Spanish social security and pay for it yourself.

*Countries with which Spain has an agreement on the mutual recognition of social security: EU+ Andorra, Argentina, Australia, Brazil, Cape Verde, Canada, Chile, China, Colombia, South Korea, Ecuador, USA, Philippines, Japan, Morocco, Mexico, Paraguay, Peru, Dominican Republic, Russia, Senegal.

At the same time, to date, a number of EU countries (A1 certificate), the Russian Federation and the UK continue to issue valid certificates.

With an electronic signature at your disposal, you can work with all documents on your own without outside help. A digital signature can also be obtained at the Spanish consulate at your location. For example, at the Spanish Consulate in Moscow.

In order to obtain a Spanish digital signature, you need to go to the website of the Spanish Mint, which issues these certificates. You can get there using this one link.

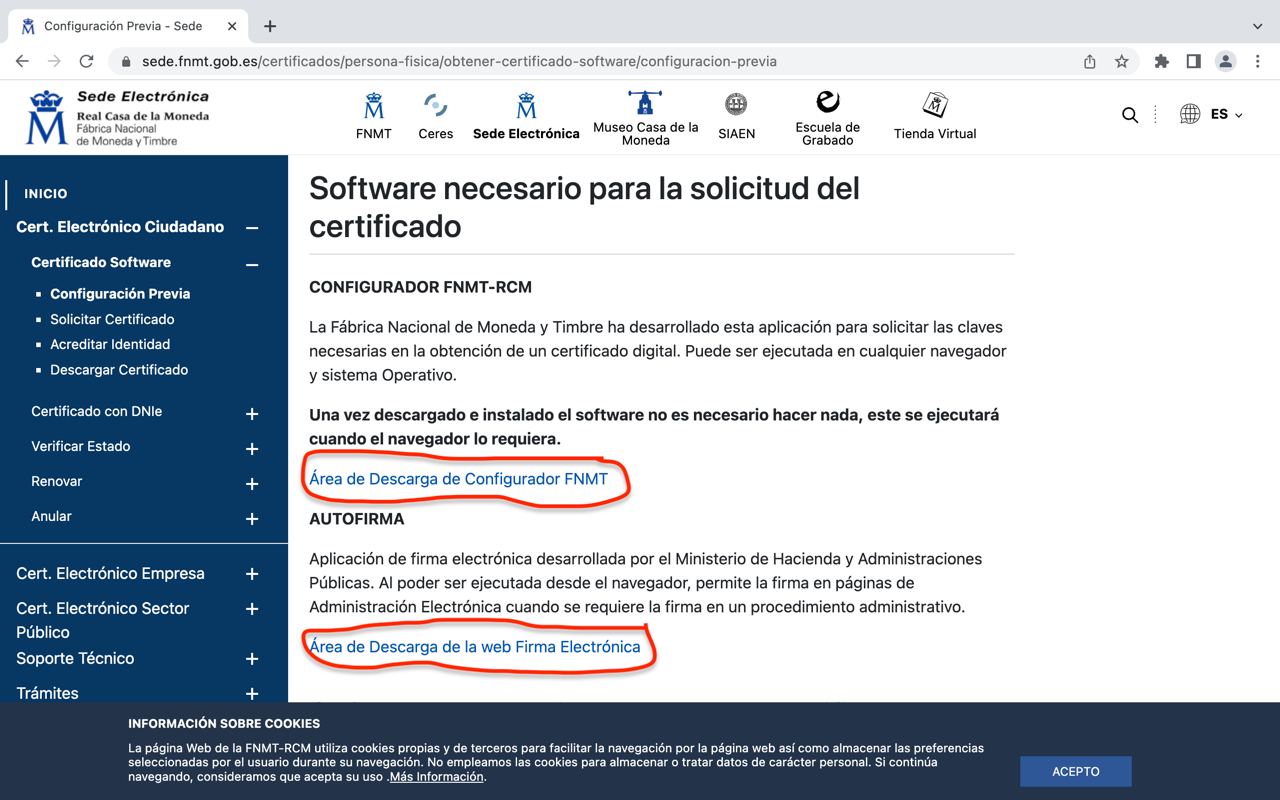

To obtain a certificate, you need to go through four steps (numbers 1-4), and we’ll start by setting up the computer so that it is ready to download the electronic certificate. Press the number 1- “Configuración previa”.

There you will need to download two small programs that are circled in red circles. The first is a certificate customizer, and the second, called Autofirma, is a program for signing documents directly.

Thus, we click on the first link, select the operating system we need and download the certificate customizer. After that, we go back and download a program called Autofirma. It is also important to note that all actions to obtain an electronic signature must be performed from the same device and browser.

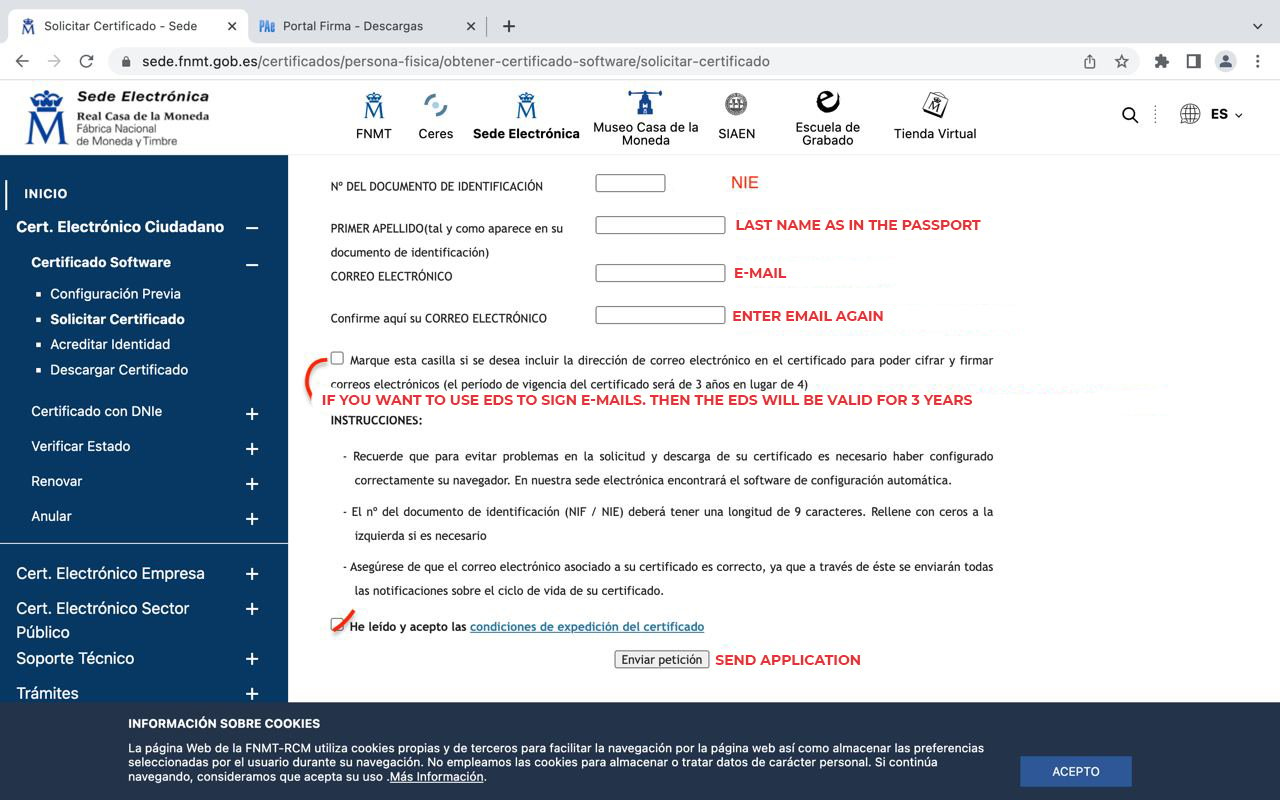

After we have pre-configured the computer, we click on item number 2, which is called “Solicitar Certificado”, and fill in the personal data according to the screenshot:

We confirm and go to point three.

Point three is called “Acreditar Identidad” — proof of identity.

If you are outside Spain, you must contact the Spanish consulate where you are located to verify your identity. As an example — information about the procedure at the consulate in Moscow.

Proof of identity in Spain:

To do this, you will need to sign up with either Seguridad Social or the Tax Service (Agencia Tributaria), come there with a passport with a NIE paper so that employees confirm your identity and provide access to downloading the electronic certificate. You also need to have an email with a code confirming that you requested an electronic signature. (Comes to your email after filling in the data in paragraph two.)

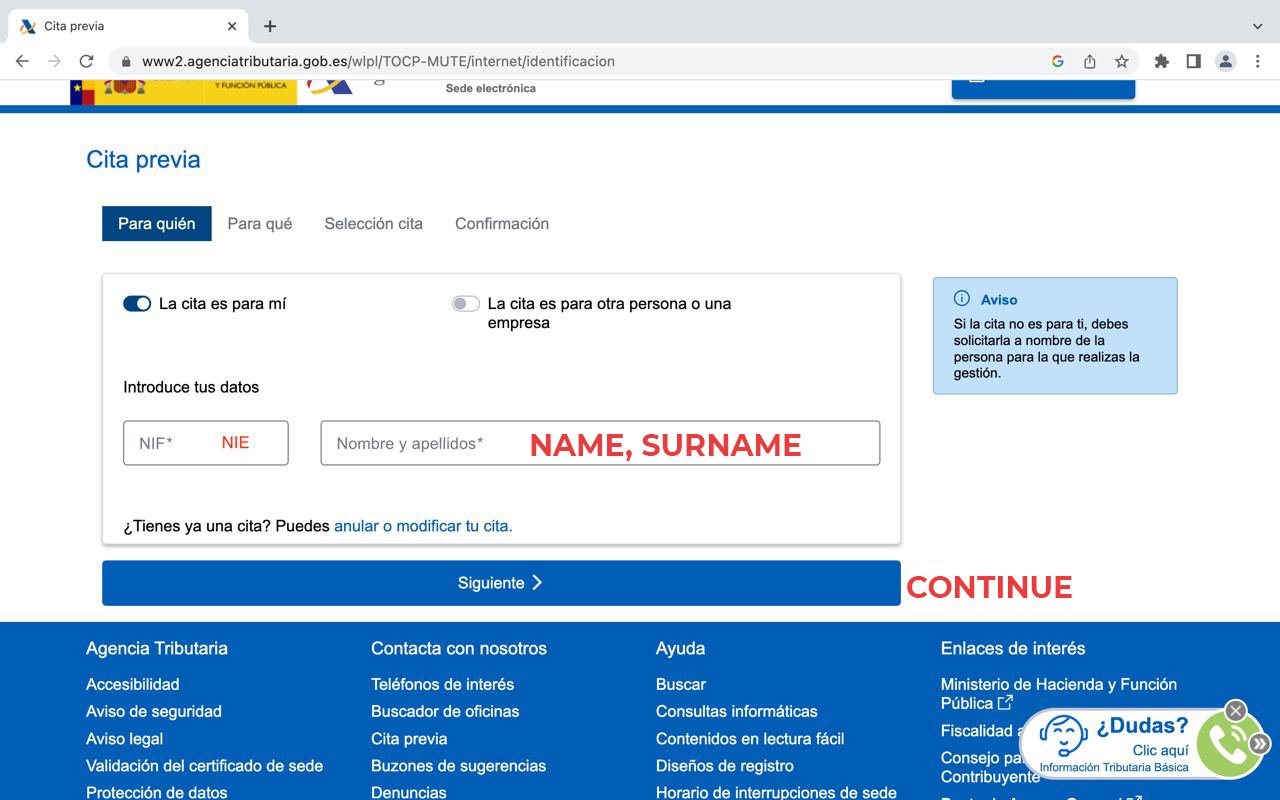

To verify your identity for a digital signature, we’ll tell you how to get an online entry to the Spanish Tax Service. First, let’s go to their official site

Select “Cita previa” -> Cita previa general -> Solicitud de cita previa para particulares.

Next, a window will open where you can fill in the data. Fill in your NIE number and, in the second column, your first and last name, as in your passport.

The next window asks you to choose what the recording is for. Choose “Certificado Electrónico FMNT”.

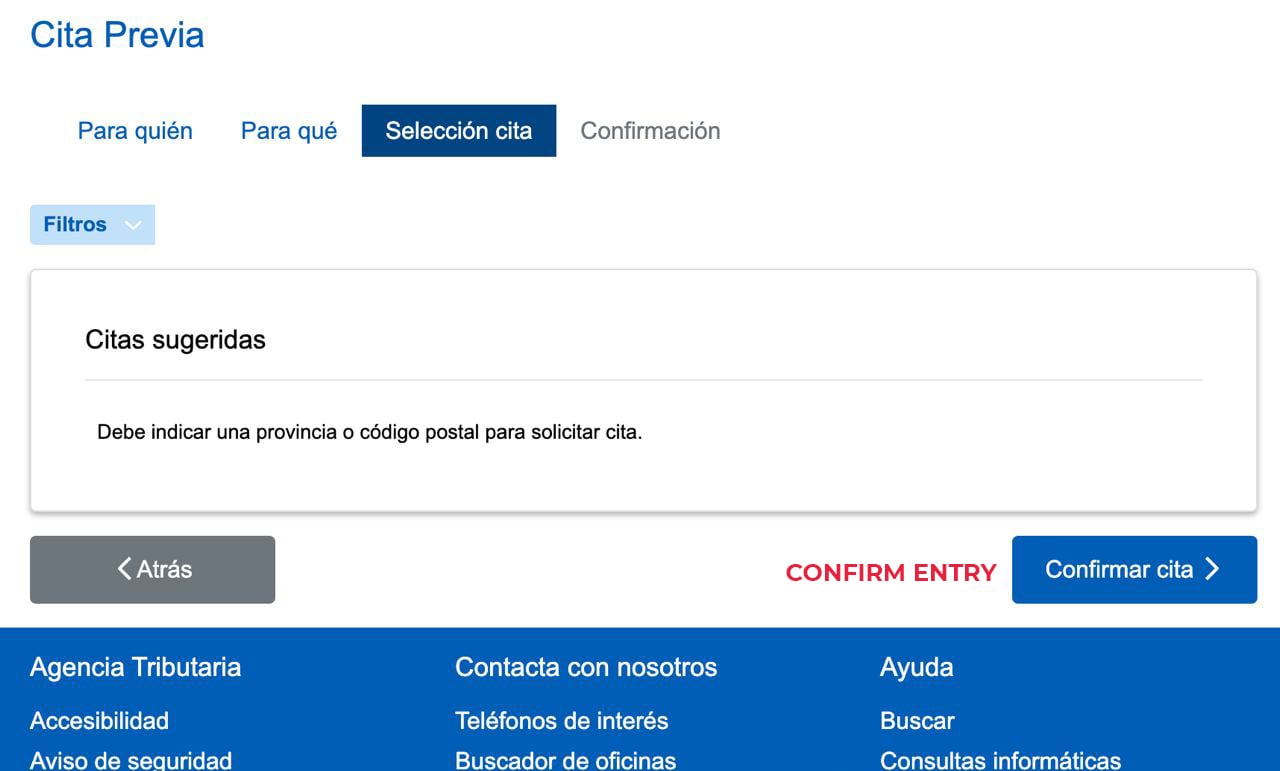

Next, you’ll need to enter your province or zip code, and the system will suggest the offices closest to your location.

After that, you can choose a convenient time for you and click the “confirm” button — “Confirmar Cita”

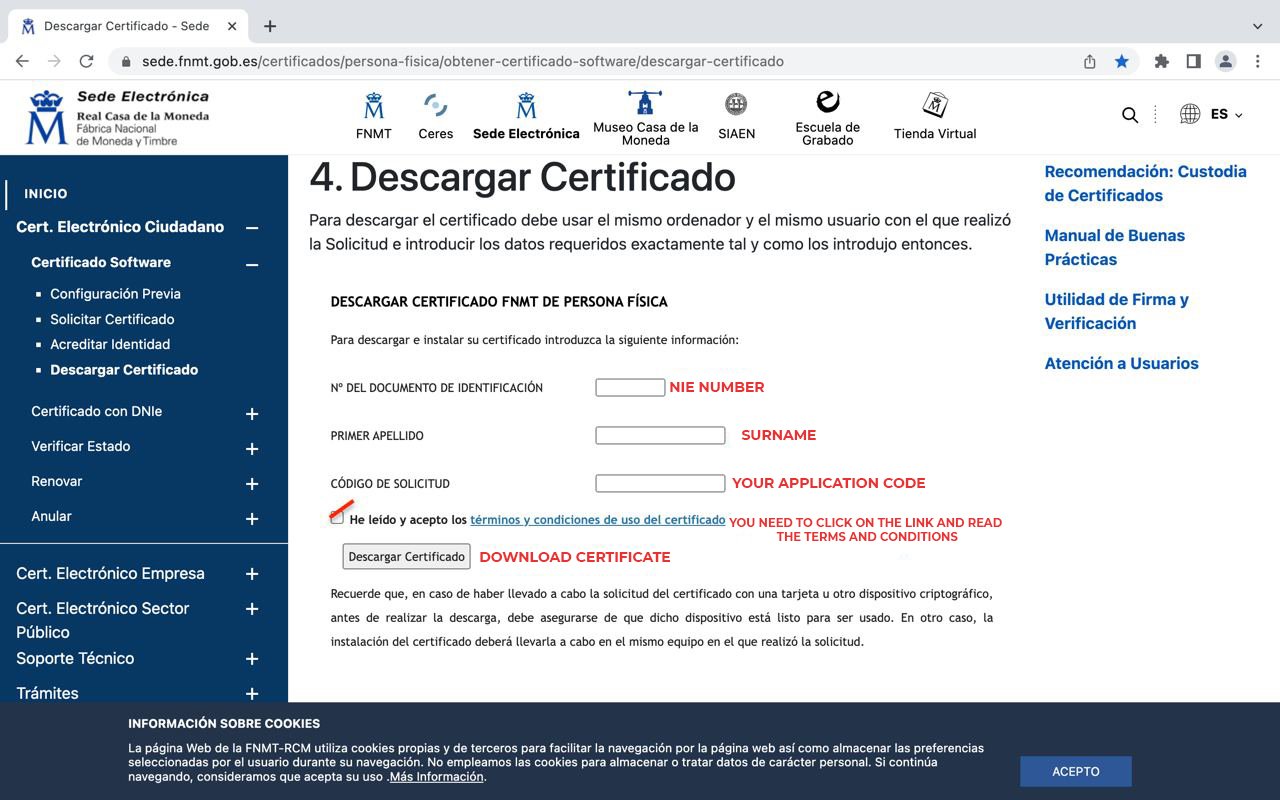

Once you’ve gone and verified your identity, we can finally move on to step four — “Descargar Certificado” — download the certificate.

To do this, you need to fill in the data according to the screenshot, after which you will open a certificate installation program that will configure everything.

After that, you will be able to use your digital certificate without restrictions to interact with Spanish authorities.

In order to pay the digital nomad’s residence permit fee, you need to go to link and log in via DIGITAL SIGNATURE:

If you pay for yourself, fill in the data like this:

If you pay for another person, fill it out like this:

After filling in, click on the “Imprimir tasa” button at the end of the page and download the finished payment document. You can pay the fee in cash at a bank or ATM. The fee is 73.26 euros.

A separate fee is required for each family member!

Do not forget to take a proof of payment; it must be attached to the application for a residence permit.

A NIE in Spain is a foreigner’s ID number, which is also used as a tax number, including for obtaining an electronic signature.

If you are not currently in Spain, you can obtain your NIE from the Spanish consulate in your place of legal residence.

For example, at the Spanish Consulate in Moscow

To do this, you need to email the EX-15 application form to the consulate without a signature. The basis for extradition is Solicitud del visado de teletrabajador de carácter internacional, Ley 28/2022 (specify in the application form). If everything is ok, you will be made an appointment at the consulate, where you will need to repay the duty (in rubles, in cash). After that, you will need to wait about 3 weeks for you to be assigned a NIE number.

If you are planning to apply for a digital nomad D visa, you must request a NIE before applying for a visa.

If you have already arrived in Spain and want to get an NIE number before getting a residence permit, you need to contact the local police (police station).

Attention! Many commissariats do not issue an NIE number just like that – you need to provide good reasons. For example, buying a home or a car. But, in this case, you may be asked to provide documentary evidence. Submission of documents for a residence permit is not such a basis, since in the case of obtaining a residence permit, the NIE number is issued automatically.

If you still want to get a NIE, then:

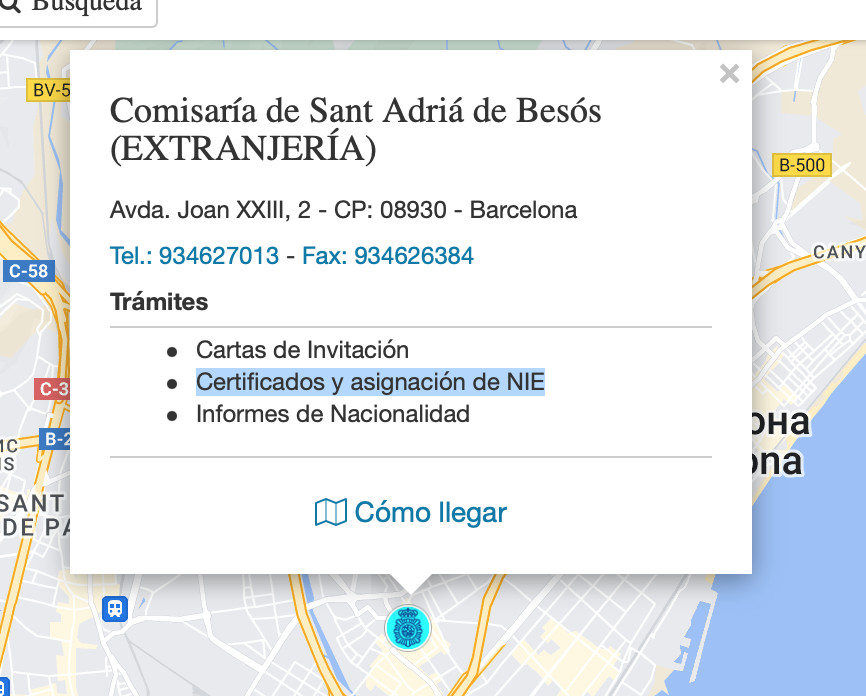

1. Find the one closest to you secession commissariat

Enter the city name, check the “Extranjería” box and click on the “Actualizar” button. Choose an office where they do “Certificados y asignación de NIE”

- After that, you will need to fill out and print the Formulario EX-15 application, as well as pay the 790-012 duty. Attention! You can pay the fee only from a Spanish account or in cash at a Spanish bank.

Application forms can be found on the official website of a Spanish police.

After that, you need to come to the police station with a printed application and a confirmation of payment stamped by the bank. After your application is processed, you will be assigned a NIE number.

You need to bring a document called the “Certificate of Departure” to the Social Fund of Russia. It usually has this format, but there may be minor variations, depending on your territorial Social Fund of Russia.

If you are an individual entrepreneur or self-employed – you don’t have to take this document, by making a commitment register with Spanish Social Security and pay insurance premiums to it. (The first year — 80 euros/month, from the second year — about 270 euros/month. With the exception of 7 autonomous regions, where you don’t have to pay for social security for the first year.)

An employee should contact the SFR authority at the place of registration of the employer.

The individual entrepreneur applies to the Social Fund of Russia authority to which it is attached.

You need to bring your passport, a certificate of employment, and a copy of the employment contract. For individual entrepreneurs — copies of documents for registering an individual entrepreneur and registering in the Pension Fund of the Russian Federation.

Note: Some Social Fund of Russia offices now issue this certificate only if you give them an order to send you on a business trip. Entrepreneurs can write such an order for themselves.

The certificate itself should not include the names of Spanish companies. Such a certificate will be refused.

Departure certificate

Social security sample for sole proprietors

UPD departure certificate

(Some branches use the old form, and some use the new form).

Fill in this document in Latin letters and sign it. (You state in Spanish that you have not broken the law in the past 5 years)

Declaration of no criminal record

Field interpretation:

Nombre y apellidos: Full name

Nacionalidad: Citizenship

Fecha de nacimiento: Date of birth

DNI/NIE/Pasaporte: Passport number

Domicilio: Address in Spain (street, house, apartment)

C.P.: Postcode

Localidad: City/Village

Provincia: Province (e.g. Girona)

/Text block/

En (name of the city where you are currently) a (number) de (month) de (year)

Firma: /applicant’s signature/

For Russian citizens who want to obtain a Schengen visa outside the country, one of the most reliable and affordable ways is to apply for a Spanish visa through Yerevan, the capital of Armenia. Since Spain did not open its consulate in Armenia, all documents are reviewed by the Spanish Consulate in Moscow. (Schengen registration for Russian citizens is also possible in Uzbekistan.)

In addition to the main list of documents for obtaining a Schengen visa, you must provide one of the following documents when applying in Yerevan:

- Residence permit

- Social card

- Local bank account

- Employment contract

The simplest option is to obtain a social card, an analogue of the Russian SNILS. Let us consider this process in more detail.

Obtaining a social card in Armenia:

- Translate your passport into Armenian by a notary (main pages with number and name, the cost ranges from 3,000 to 5,000 drams).

- Contact any local Multifunctional Center. Get your application number the next day or, if you’re lucky, the same day. It is recommended to arrive in the morning.

- Return to the Multifunctional Center by appointment and submit your documents.

The time for issuing a social card is 1 day. If you apply for a passport, you may be issued a card within 30-60 minutes. According to a Russian passport, the processing time can take up to a week.

List of documents for issuing a social card:

- Original passport

- A copy of the page with the entry stamp

- Notarized translation of the passport into Armenian

- Copy of the Russian passport (page 1+registration)

- Address in Armenia to specify in the application form (you don’t have to register at this address, you can specify a temporary residence address, such as a hotel or AirBnB). It is highly recommended to provide an address.

- In rare cases, a copy of the birth certificate may be required, and even less often copies of the main pages of parents’ passports.

The department staff will fill out the application form in Armenian if you are unable to do it yourself. After receiving a social number on an A4 sheet (“social card”), it must be stamped by the head of the passport office. Certification is carried out in a separate office.

The BLS visa center operates in Yerevan, which provides services for citizens of Russia and other countries to apply for a Schengen visa to Spain. The average processing time for applications is 3-4 weeks, but, as in Russia, it may be difficult to register.

Recording is made at website BLS.

Citizens of the Russian Federation receive visas for a period of 15 to 90 days, and documents are sent to Russia for review.

Required documents for applying for a visa to Spain:

- Passport and a copy of all its pages

- Old passport/second valid passport and copies of all pages

- Internal passport of the Russian Federation and copies of its pages

- Two photographs that meet the requirements of a Schengen visa

- Color insurance (if issued separately)

- Certificate of employment based on the model

- A bank certificate with an original seal containing information about the account balance (from 300 per person) and the movement of funds over the past 3 months

- Originals and copies of marriage and birth certificates (when the family leaves)

The process of submitting documents:

- Get an electronic queue ticket and wait for your number to appear on the scoreboard.

- Go to the filing desk. If the necessary documents are not available, they can be submitted during the working day. If you need to print something, the service is available at an additional cost.

- Go through biometric identification.

- Wait for your number to be called to pay at the checkout. There you will pay the visa fee (42,000 drams, or $107) and visa center services (15,000 drams, or $38, plus additional fees and services). Only cash in local currency is accepted.

Keep all checks issued.

Waiting for and obtaining a visa:

- Your application number (ENV*) will be on the check. It can be used to check her status on the BLS Visa Center website

- The waiting period for a visa is about a month due to sending documents to Russia

- Both the owner and another person can obtain a passport at the visa center by proxy (which must be issued in advance by a local notary).

For Russian citizens who want to obtain a Schengen visa abroad, applying for a Spanish visa in Yerevan is one of the most reliable and affordable ways. By following the instructions described above, you will be able to successfully apply for a social card in Armenia and apply for a Schengen visa with minimal problems and delays.

List of multifunctional centers in Yerevan with their addresses, contact details and working hours:

Center

Address: ul. Vratsyana, 90

Working days: Mon-Fri

Working hours: 09:00-17:00 (with a lunch break 14:00-15:00)

Contact number: +374-11-570286

Kanaker-Zeytun

Address: ul. Avetisa Aharonyan, 3

Working days: Mon-Fri

Working hours: 09:00-17:00 (with a lunch break 14:00-15:00)

Contact number: +374-11-249465

Arabkir

Address: ul. Mamikonyats, 1 (opposite “Krpak” Supermarket/Intersection of Mamikonyats Street and Azatutyan Avenue)

Working days: Mon-Fri

Working hours: 09:00-17:00 (with a lunch break 14:00-15:00)

Contact number: +374-11-282112

Avan

Address: ul. Isahakyan, 2

Working days: Mon-Thu, Fri (from 10:00)

Working hours: 09:00-17:00 (with a lunch break 14:00-15:00), Fri (10:00-17:00, with a lunch break 14:00-15:00)

Contact number: +374-11-627907

Ajapnyak

Address: ul. 10/1 Shinararneri

Working days: Mon-Fri

Working hours: 09:00-17:00 (with a lunch break 14:00-15:00)

Contact number: +374-11-380733

Davtashen

Address: 1st District, 39

Working days: Mon-Thu, Fri (from 10:00)

Working hours: 09:00-17:00 (with a lunch break 14:00-15:00), Fri (10:00-17:00, with a lunch break 14:00-15:00)

Contact number: +374-10-370264

Erebuni

Address: ul. Movses Khorenatsi, 162A

Working days: Mon-Fri

Working hours: 09:00-17:00 (with a lunch break 14:00-15:00)

Contact number: +374-11-570634

Shengavit

Address: ul. Garegina Nzhdeh, 27

Working days: Mon-FriWorking hours: 09:00-17:00 (with a lunch break 14:00-15:00)

Contact number: +374-11-449821

Malatia-Sebastia

Address: ul. Ara Sargsyan, 22

Working days: Mon-Thu, Fri (from 10:00)

Working hours: 09:00-17:00 (with a lunch break 14:00-15:00), Fri (10:00-17:00, with a lunch break 14:00-15:00)

Contact number: +374-11-392743

Nork Marash

Address: ul. Kajaznuni, 11

Working days: Mon-Fri

Working hours: 09:00-17:00 (with a lunch break 14:00-15:00)

Contact number: +374-11-550944

Nor Nork

Address: 1st microdistrict, 1st block, ul. Boryana, 1

Working days: Mon-FriWorking hours: 09:00-17:00 (with a lunch break 14:00-15:00)

Contact number: +374-11-634120

Nubarashen

Address: 17, 14th str. (Nubarashen)/In front of Surb Naatakatsa Church

Working days: Mon-FriWorking hours: 09:00-17:00 (with a lunch break 14:00-15:00)

Contact number: +374-10-475654

These MFCs also have passport and visa offices of the Yerevan Police, where you can obtain various documents and services.

General documents:

Questionnaire (2 copies, only to be signed at the consulate)

1 passport photo (must be pasted into the application form)

International passport (valid for at least 12 months and two blank pages)

A copy of all passport pages

Foreigner Identification Number (NIE) – it must be requested at the consulate at the same time as the visa

Payment of duty in rubles directly at the consulate.

Work contract, 3 months old before applying for a visa with an income of 2,646 euros/month A sworn translation is required.

Proof that your employer has been in existence and has been working for more than 1 year. An apostille and a sworn translation are required.

A copy of the diploma or proof of at least 3 years of professional experience. An apostille and a sworn translation are required.

Private health insurance provided by an insurance company accredited in Spain (subject to a social security certificate)

A police clearance certificate from all countries where you have lived for the past 2 years+a receipt confirming that there have been no offences for the past 5 years. An original certificate with an apostille + a sworn translation is required.

Russian passport with a residence registration+copies of all pages

Bank statement confirming receipt of a salary for the last 3 months. A sworn translation is required.

A CV (resume) that can be written immediately in Spanish.

A “certificate of departure” from the Social Fund of Russia or a promise to register with Spanish social security (available to individual entrepreneurs or self-employed).

Certificates in Russian are provided with a translation into Spanish, certified by the Legalization Department of the Consulate General of Spain in Moscow or with a translation made by a sworn translator officially recognized in Spain. It is not necessary to bring sworn translations with a “wet seal” — scans are enough.

Official list of sworn translators.

This memo is based on general documents issued by the Spanish Consulate in Moscow. The consulate has the right to request other documents on an individual basis. This memo also has some discrepancies with the requirements specified by the Consulate in St. Petersburg. In this regard, the article will be updated as information is clarified. The application for this visa is personal only. To receive an appointment, you must send a request to the consulate’s email address. If a family is submitted, there must be a separate entry for each family member (even for a child under 6 years old).

information about filing at the consulate in Moscow.

**Additional country documents (to be completed):

**Argentina: Argentine Residence Permit

UAE: UAE Residende visa

Serbia: Residence permit in Serbia or Montenegro.

You cannot apply by proxy, only in person.

Turkey: residence permit (tourist permit is not suitable)

Registration (Ikametgah Tezkeresi)

Philippines: ACR or ICR card (similar to residence permit)

Montenegro: Submission takes place at the Spanish Consulate in Serbia. See Serbian regulations

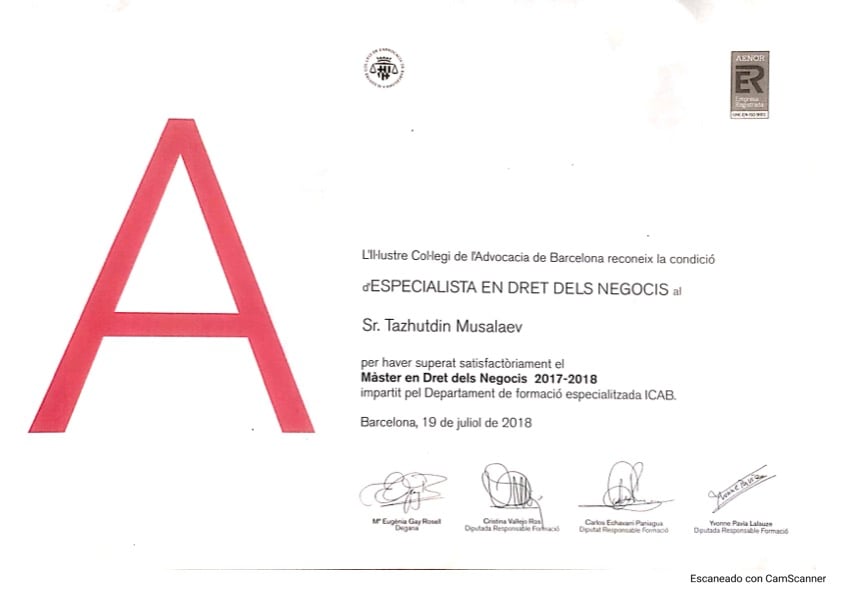

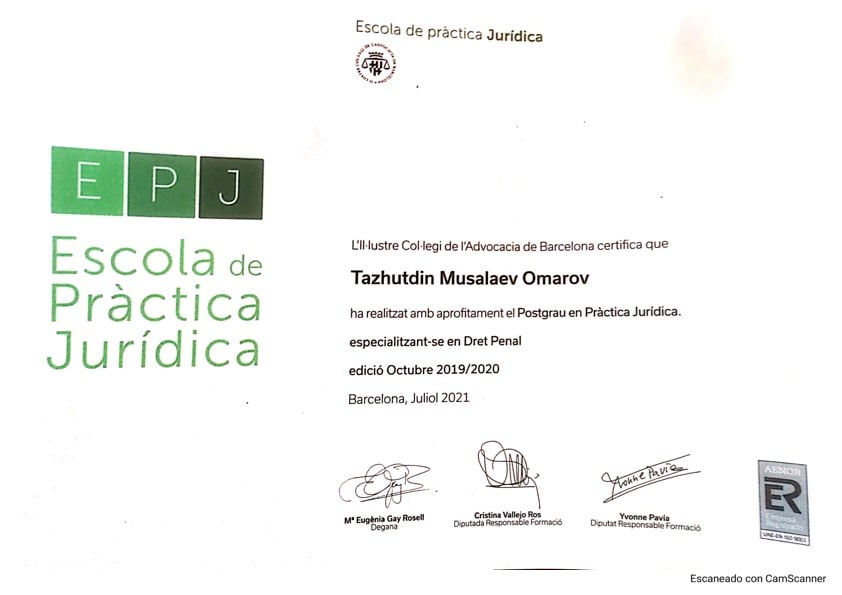

Tony Musalayev Omarov, a certified lawyer, cooperates with us.

His education is:

- Law Degree – University of Barcelona

- Master access Bar – University of Barcelona in collaboration with bar association of Barcelona

- Master Business Law – Bar association of Barcelona

- Criminal law – Bar association of Barcelona

Proof of qualifications:

Tony has been providing legal services for 8 years on the following issues:

- Advice on non-standard tax situations; assistance in planning taxes on personal and individual income, inheritance and gift taxes;

- Assistance in complex migration issues and issues of legality of imposition in Spain

- Assistance in buying property in Spain: checking purchase and sale certificates; tax support after purchase;

- Analysis of the Rental Agreement and an explanation of what rights and obligations customers will have in the future.

We also work with tax lawyers:

Javier Díaz

Licenciado en Derecho por la Universidad de Barcelona, promoción 2007.

Master en Asesoria y Gestión Tributaria por la escuela de negocios ESADE, promotion 2008

Certificate European Financial Advisor (€FA), expedición 2011, nº asociado 9775.

Executive MBA por la escuela de negotios ESADE, promotion 2018.

Colegiado ejerciente en el Ilustre Colegio de los Abogados de Madrid, nº 132791.

Areas de Especialization: Tax, Corporate and Digital Law

Mariangeles Roy

Licenciada en Derecho por la Universidad Pompeu Fabra de Barcelona, promoción 2007

Licenciada en Economia por la Universidad Pompeu Fabra de Barcelona, promoción 2007

Master en Tributación por el Centro de Estudios Financieros, promoción 2008.

Areas de specialization: Tax and Corporate

If you are a sole trader in one of the countries that have a social security mutual recognition agreement with Spain, * you can choose between two options.

Variant 1 (hiring, individual entrepreneur): Provide Spain with a certificate that you are covered by social security in your country (departure certificate) + buy private health insurance in Spain. (Travel insurance or Schengen visas are not suitable. You need insurance from one of the Spanish insurance companies. For example Adeslas, Sanitas, DKV…)

Pros: Private insurance can be serviced in large private hospitals and medical centers.

This is cheaper than paying social security, as the average cost of private insurance with full coverage is 50 euros/month, and the social security contribution is 300 euros/month, starting from the second year (the first year is 80 euro/month)

Variant 2 (for individual entrepreneurs, self-employed, freelancers): Register with the Spanish social security system (after obtaining a nomad residence permit). In this case, you do not need to purchase private health insurance. Also, this option does not require a departure certificate

Pros: In addition to access to public hospitals and polyclinics, you have accumulated retirement experience and the opportunity to receive various state benefits (for childcare, for example).

For a family of three or more people, this option will be comparable or even cheaper than private insurance, since the total cost of private insurance for a family with young children will be approximately 250 euros/month

If the country in which you are registered as an individual entrepreneur does not have an agreement with Spain on the mutual recognition of social security, then you will need to register with the Spanish social security system (after obtaining a nomad residence permit). In this case, you do not need to purchase private health insurance.

What should I do if I am employed in a country where there is no social security agreement?

Revise your sole proprietor/freelance agreement, wait 3 months, promise to register with Spanish social security and pay for it yourself.

*Countries with which Spain has an agreement on the mutual recognition of social security: EU+ Andorra, Argentina, Australia, Brazil, Cape Verde, Canada, Chile, China, Colombia, South Korea, Ecuador, USA, Philippines, Japan, Morocco, Mexico, Paraguay, Peru, Dominican Republic, Russia, Senegal.

At the same time, only a number of EU countries (A1 certificate), the Russian Federation and the UK continue to issue valid certificates.